The capital market is not merely a place to buy and sell stocks, but it includes activities such as public offerings and securities trading. It is also the place where public companies sell securities, and entities and occupations that deal with securities ply their trade.

It was stated by Dewi Arum Prasetyaningtyas, Head of the Legal Division of the Indonesia Stock Exchange, stated on Wednesday (31/3/2021) as she provided insights regarding the capital market.

There are plenty of benefits to the existence of the capital market. First, both new and existing companies can access cash or capital through capital markets. This money is used by companies to finance day-to-day running expenses and to fund expansions. Employment development, economic growth, and technological advancement are all the benefits of capital markets.

Aside from physical venues such as stock exchanges, capital market transactions also include private investment agreements between individuals and businesses. Some of such deals are brokered by private equity firms that introduce investors to firms seeking capital. In other instances, a business owner may directly approach an individual and ask for a loan or a capital infusion. Many mainstream lenders are unwilling to finance start-up firms or businesses engaged in speculative ventures. The advantages of capital markets also include the fact that high-risk borrowers can gain access to much-needed funds.

Companies profit directly from capital markets because many businesses would go insolvent if there were no formal or informal investment marketplaces. Employees of companies that grow and develop due to capital infusions benefit from capital markets as well. These people have more chances for progression and promotion in their professions. Additionally, expanding companies open new plants and offices, resulting in the creation of employment in addition to recent work locations. New technologies are created as companies grow, and researchers and marketing agents are hired to develop and refine these products.

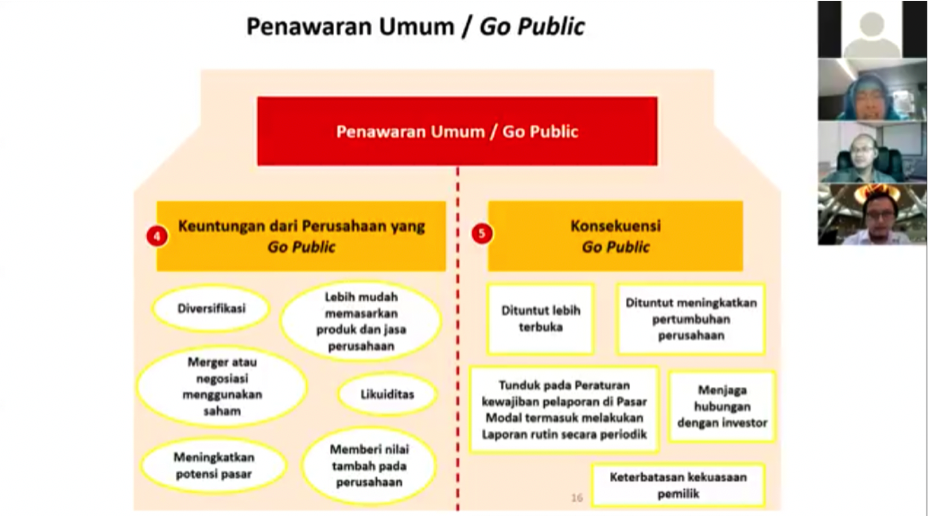

Obviously, these advantages come with consequences. “For example, with public investors’ addition, the company’s founding shareholders no longer own 100 percent of the company and must share their votes at the regular general meeting of shareholders,” said Dewi.

The company’s founding shareholders, on the other hand, need not be worried about losing control. As long as their shareholding is greater than 50 percent of the total paid-up stock, or if they have the right to decide the management or policy of the Public Company, founding shareholders will maintain their position as controlling shareholders.

Second, companies whose shares are listed on the Indonesian Stock Exchange are subject to the regulations of the Financial Services Authority (OJK- Otoritas Jasa Keuangan) and the Indonesian Stock Exchange. These regulations cover various topics, including information transparency and disclosure, to ensure that all shareholders have access to the information they need to make informed investment decisions. Another condition that must be met is to establish a corporate authority, each of which has a particular role in carrying out good corporate governance. This is intended to help businesses grow in a positive, competitive, competent, and sustainable manner.

Code of ethics

Dewi then discussed the code of ethics and its advantages in running an organization. A code of ethics is a set of guidelines intended to help professionals conduct business honestly and ethically. The company’s missions and ideals can be outlined in a code of ethics document and how practitioners are required to address issues, ethical principles based on the organization’s core values, and the standards to which the professionals are kept. The advantages include strengthening its core values, ideals, community, vision, and mission establishment, and building its image in the marketplace.

Last but not least is the highlight of actions that are prohibited in trading. Given was a case of a salesperson in a company that owns an extensive stock portfolio. This salesperson influences a few investors to purchase the said stock by saying that it has a good prospect and will increase in value in the near future. Afterward, when the convinced investors buy the stocks, the stock price began to increase, and the said salesperson managed to receive personal gains through selling his stocks when the price is rising.

This example is referred to as market manipulation, a form of market fraud in which a deliberate effort is made to obstruct the market’s free and fair operation. The most egregious cases include making false or misleading appearances about a product’s, security’s, or commodity’s price or market —which is as mentioned in the given example.