Tax plays an important role in the development. Eighty-three percent of national income comes from tax, and personal tax is one sector that gives a major contribution. However, many people are not capable of calculating and managing their taxes, mainly personal tax.

This issue was highlighted in financial planning class in a guest lecture session, where SBM ITB invited a tax consultant, Wirna Sulilestari MBA, to educate students about personal tax. In a lecture entitled “Personal tax obligation,” Wirna explained personal tax and how to calculate it.

This issue was highlighted in financial planning class in a guest lecture session, where SBM ITB invited a tax consultant, Wirna Sulilestari MBA, to educate students about personal tax. In a lecture entitled “Personal tax obligation,” Wirna explained personal tax and how to calculate it.

Personal tax refers to the imposition of taxes on individual tax subjects on income received or earned in the tax year. Wirna explained that people who have generated income must pay tax.

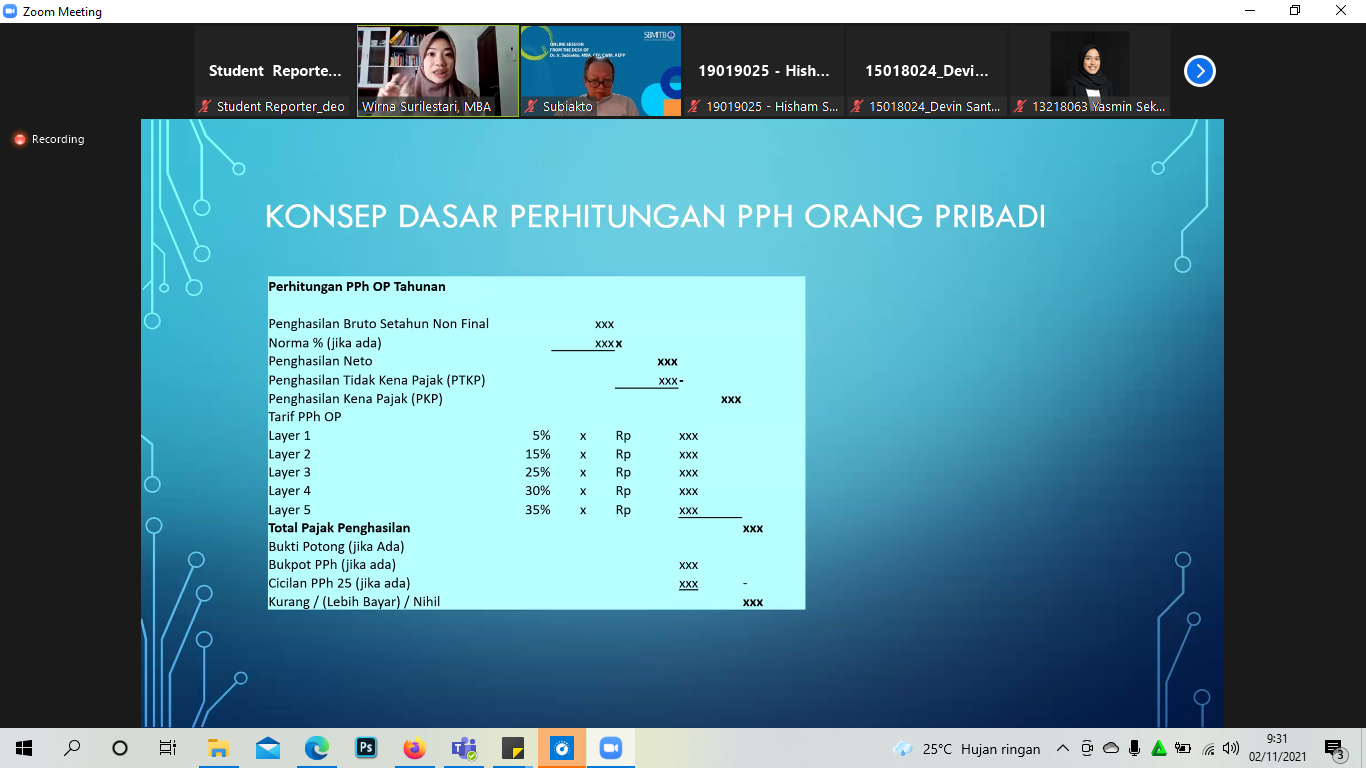

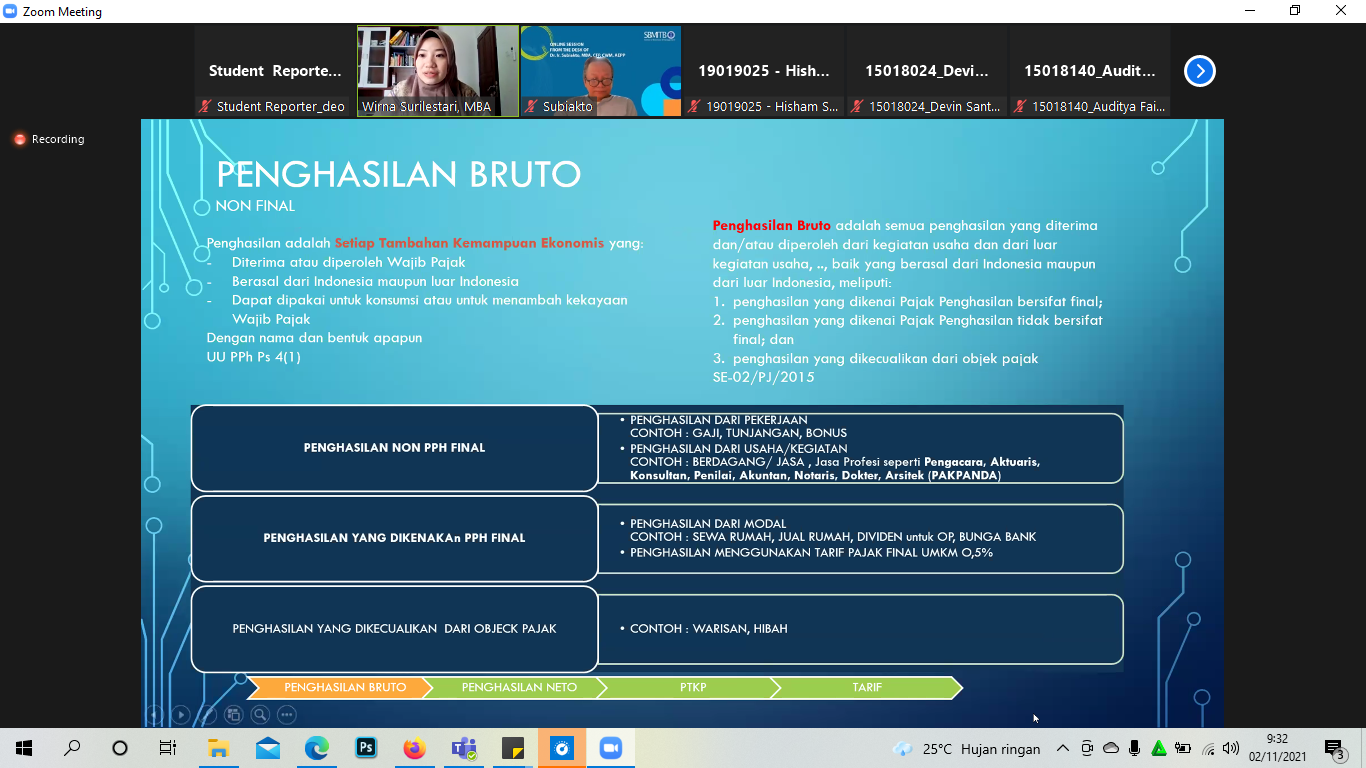

To calculate how much tax we should pay, the first step is to calculate our gross income. Wirna revealed that gross income is the total income that we get from business activities or non-business activities, such as your salary as a lecturer, lawyer, or doctor and your income from your business.

Wirna gives an example if you have a salary as an employee and earn around IDR. 1.000.000.000 per year, at the same time, you are also working as a freelance consultant with total income revenue IDR 100.000.000 yearly, meaning that you have IDR 1.100.000 gross income. After calculating gross income, the next step is to calculate net income and deduct it with non-taxable income.

During the presentation, Wirna also showed the students how to register themselves to get tax ID ( NPWP) through a website provided by the Directorate General of Taxes (Direktorat Jendral Pajak).

Through this lecture, Wirna hoped that the students would be obedient taxpayers.” If you are late (in paying the tax), you will be subject to administrative sanctions of interest,” explained Wirna.

Written by Student Reporter (Deo Fernando, Entrepreneurship 2021)