Unlike the industrial revolution era of a few decades ago, today’s rapid and massive innovations have reached many aspects of our daily lives. Our lives will no longer be the same in the future, especially with blockchain and cryptocurrencies. So, how do we respond to these innovations? Are we prepared to deal with all of the changes that follow?

SBM ITB collaborated with Boston University to hold virtual lectures by Professor Irena Vodenska, Ph. D., CFA, the Director, Finance Programs and Chair, Administrative Sciences Department Metropolitan College, Boston University, Wednesday (20/4/2022).

SBM ITB collaborated with Boston University to hold virtual lectures by Professor Irena Vodenska, Ph. D., CFA, the Director, Finance Programs and Chair, Administrative Sciences Department Metropolitan College, Boston University, Wednesday (20/4/2022).

Cryptocurrency and blockchain are currently being discussed at various seminars, meetings, classrooms, podcasts, YouTube, and other platforms. Bitcoin trading data has risen to US$ 30-40 thousand today, having once reached US$ 60 thousand, even though everything begins with one cent per bitcoin. With such enormous potential, it is common for many startups to use blockchain as the foundation of their business.

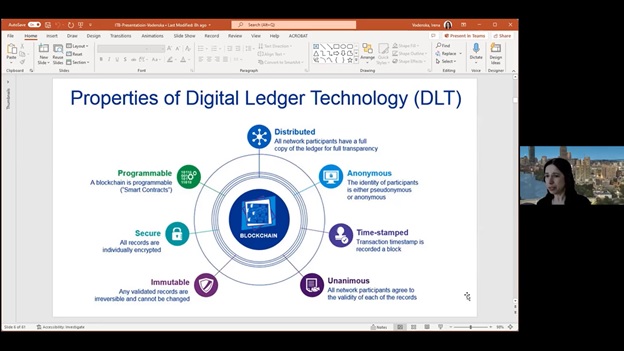

Cryptocurrencies are essentially digital currencies, represented by a set of numbers in blocks generated by algorithms and distributed across multiple computers. The outline describing cryptocurrencies is distributed, anonymous, time-stamped, unanimous, immutable, secure, and programable as part of Digital Ledger Technology (DLT).

Each country has its own set of considerations for implementing blockchain technology. Since 2013, there has been an increase in awareness of the need to manage cryptocurrency in the United States. It is based on the understanding and treatment of bitcoin, which is treated as property. Meanwhile, Australia adopted bitcoin and cryptocurrency transaction technology over two years.

Switzerland is home to some of the world’s greatest blockchain companies. Like Silicon Valley in America, Switzerland can be referred to as a “Crypto Valley.” Whereas in this case, they provide a powerful platform for accelerating the growth of the global cryptocurrency ecosystem, starting with a qualified infrastructure and moving on to world-class talent. In addition, they provide access to crypto-friendly government through accepting cryptocurrency tax payments and a blockchain-based electoral system.

In Asia, Japan is a pioneer in using cryptocurrencies in the legal system. Japan also has the most bitcoin traders, with total transactions in Q4 2017 accounting for 40% of all bitcoin transactions worldwide.

China, for one, welcomes related technology with open arms. China is currently home to several blockchain-based startups, beginning with the private sector. On the banking side, a consortium has stated that it will explore blockchain. Finally, the government actively supports top cryptocurrencies and smart contract platforms.

The crypto community in Indonesia is steadily growing. Binance founder Changpeng Zao stated that the crypto ecosystem in Indonesia is promising, and it can become the central leader of the crypto and blockchain ecosystem in Southeast Asia. Although not everyone agrees, many projects have adopted this technology.

Blockchain innovation has the potential to be applied in a wide range of fields, including in digital identity, recording, security, purchasing and selling financial products, sharing economy, recording financial data, housing, recording land certificates, supply chains, insurance, clinical trials for cancer research, etc.

The sharing economy is a clear example of a blockchain application where blockchain can eliminate the middlemen and directly connect buyers and sellers.

“When we try to buy something or look for services that require us to travel, we are looking for a platform to rent. To travel, we require an online-based vehicle and a variety of other supporting platforms. With the concept of a blockchain-based sharing economy, we only need one platform for everything,” said Professor Irena Vodenska.

Financial or banking data, like the previous example, is concise. When we enter data into one bank, we do not need to re-enter it when visiting another. Instead, we only need to confirm the ownership information on the file at the bank. This ownership data is accessible to many parties, and almost all companies will have access to it in the future.

“With prudent blockchain record management, we can feel more secure, confident, and undisturbed; we can also have accurate data and gain other benefits,” said Professor Irena Vodenska.

Initial Coin Offering (ICO)

The Initial Coin Offering (ICO) is a novel method of obtaining working capital. The only difference between it and a traditional Initial Public Offering (IPO) is that it is stored in cryptocurrency. It is common for startups related to cryptocurrencies or blockchain.

“ICOs and crowdfunding are similar in that they both seek investors who are willing to support a project, movement, or product that has the potential to profit from the investment results they save,” said Professor Irena Vodenska.

Cryptocurrencies on the blockchain are used for ICO fundraising. This is analogous to the company owning a share to guarantee ownership of the investment deposited.

Opportunity And Challenges

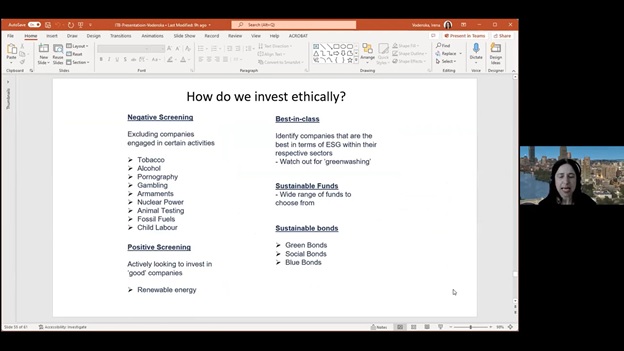

Beginning with the ‘Paris Agreement of 2015,’ 195 countries representing 90% of global economic activity agreed to reduce global temperatures. This has ramifications in various fields, including finance, where ongoing actions and investments prioritize clean growth while supporting the environment and social well-being. So, how do we make our investments have an ethical impact on this?

According to Professor Irena Vodenska, we must evaluate and investigate the investment product we will select. It is preferable to invest our money in investments with a positive environmental and social impact. By not supporting companies involved in the alcoholic beverage industry, gambling, animal testing, nuclear power, fossil fuels, child labor, and so on, we are already preserving various living things on Earth.

“This may seem trivial, but putting our capital in places that harm the environment and society means contributing to rising global temperatures, pollution, the extinction of biodiversity, and various social inequalities, impacting our health and future generations,” Professor Irena Vodenska concluded.

You don’t want to miss out! Subscribe to and enable notifications from the SBM ITB YouTube Channel for the latest exciting news! To view the full video, follow this link. https://www.youtube.com/watch?v=dt4C20pNiFg