“Never fall in love at first sight, especially in the business world,” said John Octavianus, the CEO of Origin Technology Indonesia, when presenting as a guest lecture in the Entrepreneurial Finance course on Monday, November 28, 2022.

John’s statement is relevant because investors are immediately interested in a company. However, after establishing a long cooperative relationship, pros and cons emerged from the company.

The lecture began with a video illustrating the matter. John continued his presentation by giving two choices of green and blue boxes.

Inside is writing that describes the characteristics of several companies. Then students will choose and be free to argue about the reasons for that choice.

“I prefer green boxes, with big debts in our company. There will be greater opportunities for us to develop further and grow the company faster,” said Lou, one of the 2020 SBM ITB students.

John Octavianus also presented material on Introduction to Capital Raising. The three main sources of funds for a company are retained earnings, debt capital, and equity capital.

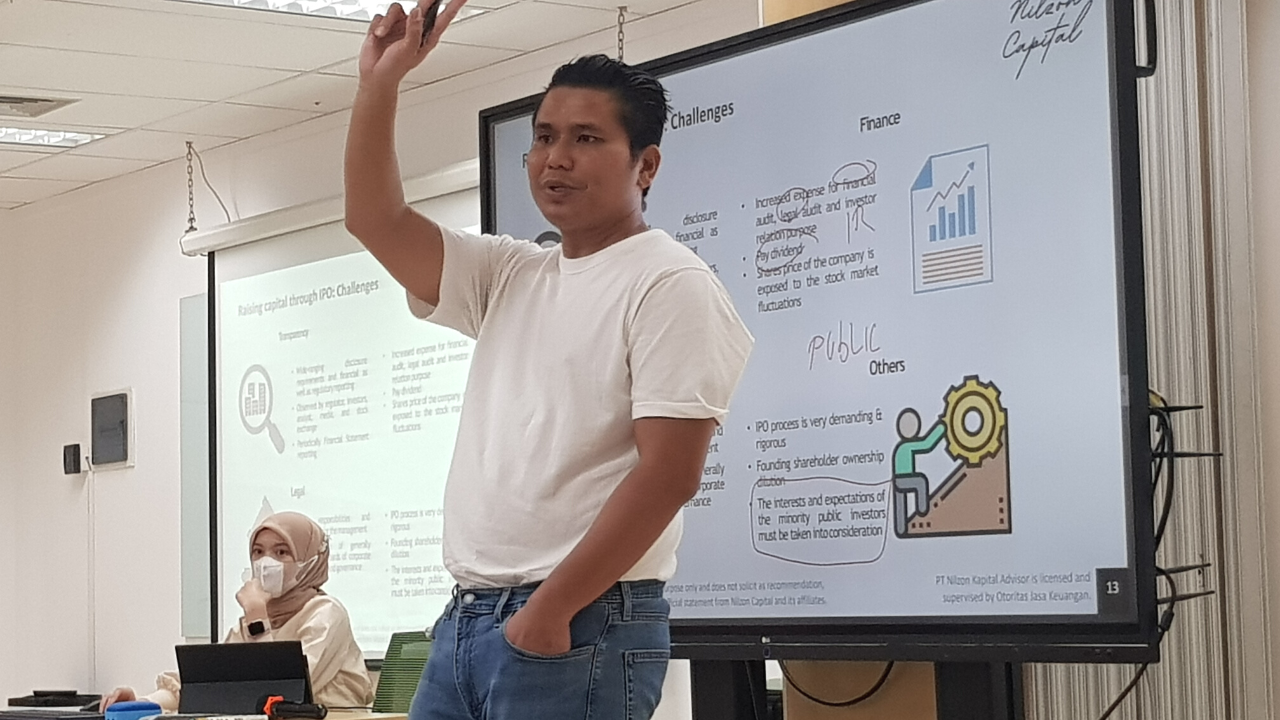

The implementation of capital raising itself has its pros and cons. The implementation process of capital raising can be done through an Initial Public Offering (IPO).

The IPO itself has advantages in the fields of finance, and development, even on the side related to the government. Then, to increase capital participation through IPO, it will be carried out in three stages: pre-IPO, IPO, and post-IPO.

The class closes by giving assignments to students to analyze a company’s financial statements and make projections for the next three years.