Data fraud and misuse are widespread. The use of photos, data modification, and others are happening in Indonesian society today. This type of unethical behavior is especially sensitive in the financial sector. So, how do we reduce this?. Telkom Indonesia and ITB collaborated to create a virtual webinar on Friday (1/4/2022). The event, entitled “Big Data: The Era Of E-KYC As Digital Onboarding,” featured expert speakers, such as the Director of Big Data & Business Analytics Laboratory SBM ITB, Manahan Siallagan, the Tribe Leader Big Data & Smart Platform Telkom Indonesia, Agus Laksono, and the CEO & Co-Founder Verihubs, Rick Firnando.

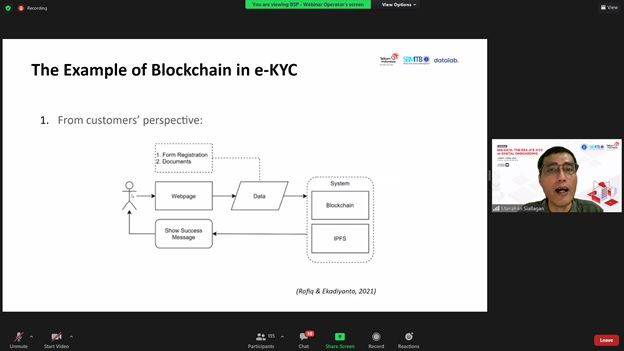

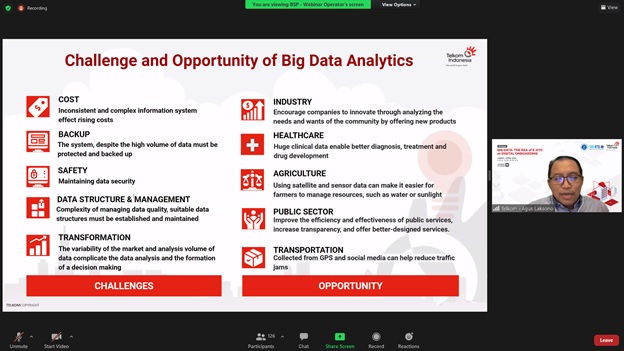

Today, companies receive massive amounts of data. The process of sorting, verifying, and so on can be quite draining in terms of energy, time, and money. It is not uncommon for violation occurs exist in between. “This activity, however, can be avoided by utilizing big data in conjunction with various supporting analytical technologies, such as facial recognition, retina recognition, biometric recognition, and so on. It is hoped that by using this technology, the verification process will be instant, there will be an increase in security, and there will be an increase in effective and efficient productivity.” Agus stated

Manahan, as an academic, added his analysis from the social side and other impacts. Manahan stated that this KYC is governed by Bank Indonesia Regulation No.3/10/PBI/2001 and Bank Indonesia Regulation No.3/23/PBI/2001 on the Implementation of Know Your Customer Principles. However, given the sophistication of technology’s advancement, this regulation needs to be updated.

“It is unavoidable that this technology will keep advancing. What should be built in line with the development of technology are familiarity across generations, regulatory support that makes technology useful for many people, and social construction factors that can support the benefits of this technology,” Manahan explained.